SP500 LDN TRADING UPDATE 15/1/26

SP500 LDN TRADING UPDATE 15/1/26

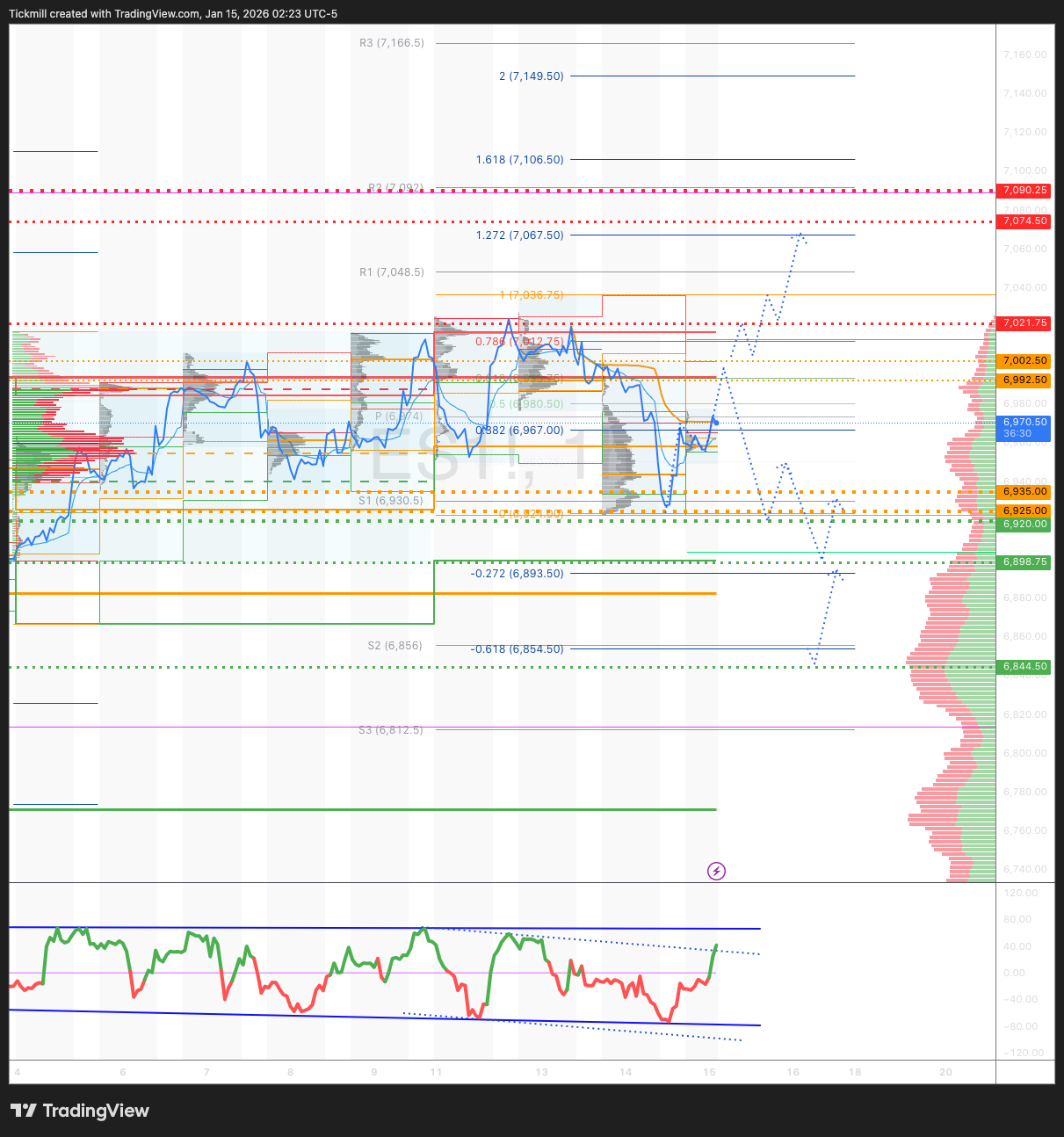

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6925/35

WEEKLY RANGE RES 7090 SUP 6920

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6938

MONTHLY VWAP BULLISH 6854

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6932

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip zone is around the 6880 level. There is a sharp increase in upside gamma starting at 6970 and above. Conversely, below 6770, the downside gamma becomes very steep.

DAILY STRUCTURE – BALANCE - 7024/6923

DAILY VWAP BEARISH - 6995

DAILY BULL BEAR ZONE 6992.5/7002.5

DAILY RANGE RES 7021 SUP 6

2 SIGMA RES 7115 SUP 6884

VIX BULL BEAR ZONE 17.7

PUT/CALL RATIO 1.27

TRADES & TARGETS

SHORT ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON REJECT/RECLAIM WEEKLY RANGE SUP TARGET 6955

LONG ON REJECT/RECLAIM DAILY RANGE SUP TARGET WEEKLY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “DEFENSIVE TILT”

S&P closed down 53bps at 6,927, with a Market-on-Close (MOC) imbalance of $3.2bn to buy. NDX dropped 107bps to 25,466, while R2K gained 71bps to 2,652, and the Dow slipped 9bps to 49,150. A total of 22.5 billion shares traded across all U.S. equity exchanges, significantly above the year-to-date daily average of 17.73 billion shares. The VIX rose 507bps to 16.78, WTI Crude declined 162bps to $60.17, the U.S. 10-year yield fell 4bps to 4.14%, gold increased 95bps to 4,630, the DXY edged down 4bps to 99.10, and Bitcoin surged 364bps to $97,515.

The S&P underperformed its Equal Weighted Index by approximately 1%, with defensive posturing evident amid various geopolitical developments, earnings reports, and the anticipated IEEPA ruling, which did not materialize today. Large banks and fintech stocks remained under pressure, partly due to CCCA uncertainty and fund outflows, particularly from money center banks, which remain the most crowded subsector within financials. However, alternative assets and regional banks showed some recovery from their lows, indicating that "headline risk perception" remains a key driver—or perhaps large banks are simply losing momentum with their premium valuations.

Staples continued their upward trajectory, gaining over 1% today and more than 5% over the past five sessions. Strength in large-cap names like Walmart (WMT) and Costco (COST) has contributed to the rally, despite ongoing challenges such as GLP-1 concerns impacting packaged foods and beverages. Better-than-expected earnings from STZ and SMPL last week also provided support. Notably, staples were the most net-sold sector in PB last week, but this trend appears to be reversing. Meanwhile, tech and AI continue to lag, suggesting new capital is flowing into other sectors, including staples and broader consumer categories, a shift from last year’s trends.

Activity levels on our trading floor were subdued, scoring a 4 on a 1-10 scale. The floor finished the day down 120bps for sale, compared to the 30-day average of -49bps. Investor activity was quieter as they navigated this week’s barrage of Trump-related headlines. Asset managers were net sellers by approximately $1 billion, with broad supply across multiple sectors, particularly in tech and healthcare. Hedge funds also ended the day as net sellers (-$700 million), driven by tech and macro sectors. Key events tomorrow include overseas updates from Richemont and TSM, as well as U.S. earnings reports from BLK, GS, and MS before the market opens, and JBHT after the close.

After hours, Coinbase CEO Brian Armstrong announced he is withdrawing support for the crypto market-structure bill, adding to the uncertainty in the cryptocurrency space.

In derivatives, volatility eased throughout the day, with skew steepening again. Realized skew has been weak year-to-date. Despite intraday lows, there was minimal demand for gamma, and we prefer running long at-the-money (ATM) rather than downside gamma. Another key narrative is the divergence between the RUT and NDX. The RUT closed higher for the day, while tech continues to flirt with negative year-to-date performance. While hedging activity is evident, conviction seems lacking. RUT volatility has outperformed, and the desk continues to favor short skew trades, with the RUT vol spread offering attractive carry and serving as a good local hedge. The straddle for tomorrow closed around 56bps, extending to approximately 77bps for Friday. (h/t Shayna Peart).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!