REAL TIME NEWS

Loading...

VWAP Swing Strategy Daily Update 02/03/26A daily review of the VWAP Swing Strategy setups -https://www.tradingview.com/chart/XTIUSD/axpUSQP7-VWAP-Swing-Strategy-Daily-Update-02-03-26/...

VWAP Swing Strategy Daily Update 02/03/26A daily review of the VWAP Swing Strategy setups -https://www.tradingview.com/chart/XTIUSD/axpUSQP7-VWAP-Swin

Title AUDNZD H4 | Bullish continuation setupType Bullish bounce Preference The price is falling towards the pivot at 1.18282, a pullback support that is slightly above the 38.2% Fibonacci retracement. A bounce at this level could lead the price toward the 1st resis...

Title AUDNZD H4 | Bullish continuation setupType Bullish bounce Preference The price is falling towards the pivot at 1.18282, a pullback support that

US/Israel Attack IranOil prices are seeing significant volatility at the start of the week following news over the weekend of the US and Israel attacking Iran. Joint missile strikes on Iran led to the killing of the Iranian Supreme Leader, provoking retaliatory att...

US/Israel Attack IranOil prices are seeing significant volatility at the start of the week following news over the weekend of the US and Israel attack

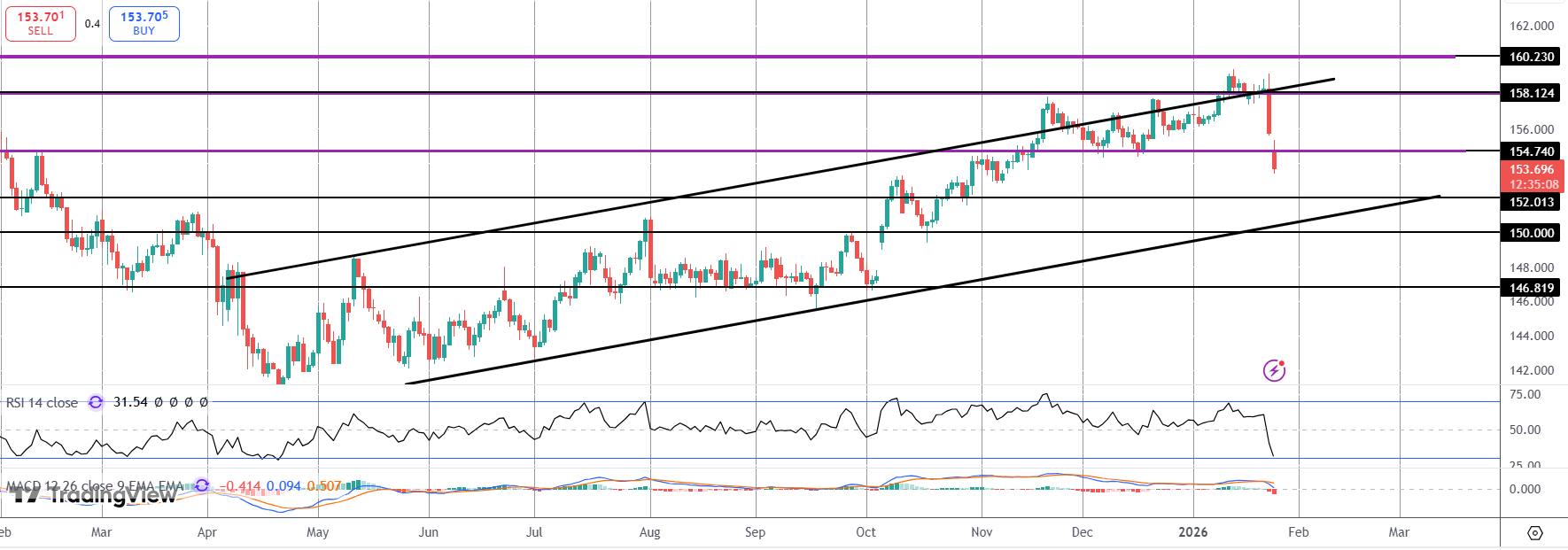

Pound Under PressureThe British Pound is coming under heavy selling pressure today with GBPUSD hitting fresh 1-month lows. Part of the move lower is in response to a stronger US-Dollar which has risen on safe-haven demand following news over the weekend of joint US...

Pound Under PressureThe British Pound is coming under heavy selling pressure today with GBPUSD hitting fresh 1-month lows. Part of the move lower is i

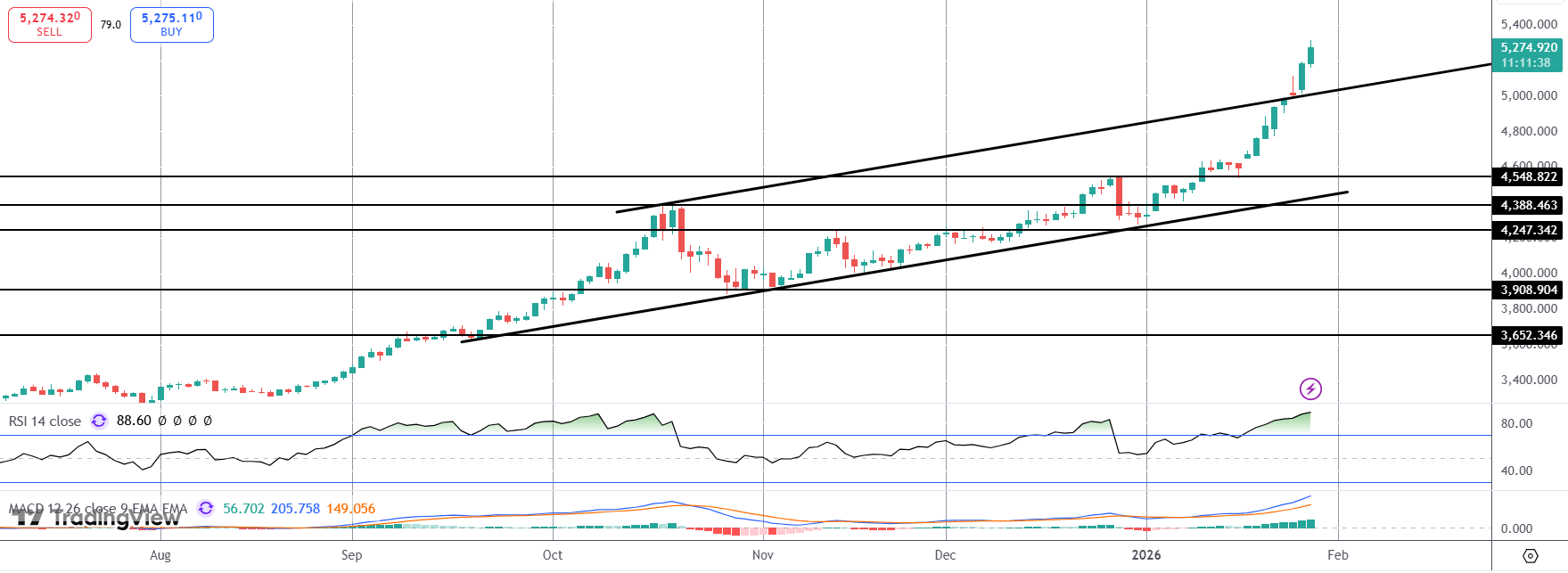

March’s seasonality picture is surprisingly constructive for US equities, awkward for bonds, and historically supportive for oil/commodities—with the big caveat that macro/geopolitical shocks are already distorting the “typical” path (especially in crude). Below is...

March’s seasonality picture is surprisingly constructive for US equities, awkward for bonds, and historically supportive for oil/commodities—with the

Daily Market Outlook, March 2, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The ongoing conflict in the Middle East shook global investor confidence, causing markets to tumble and oil prices to rise. This uncertainty sparke...

Daily Market Outlook, March 2, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The ongoing conflict in the Midd

GLOBAL MACRO (WILSON) – Global Markets Commentary: Market Insights After Iran Strikes –BOTTOM LINE: The primary channel through which the Iran crisis affects the global economy and macro markets is its influence on energy markets. The severity and expected duration...

GLOBAL MACRO (WILSON) – Global Markets Commentary: Market Insights After Iran Strikes –BOTTOM LINE: The primary channel through which the Iran crisis

1) Core regime call: stay defensive, fade relief rallies (near term)Market is in reduce-risk mode, with geopolitics + heavy US data (ISM/NFP) keeping volatility elevated.USD dips likely to be bought while uncertainty persists.Action: Prioritize sell-rallies in USD ...

1) Core regime call: stay defensive, fade relief rallies (near term)Market is in reduce-risk mode, with geopolitics + heavy US data (ISM/NFP) keeping

Rising Safe-Haven DemandAmidst the market fallout from the US/Israel attack on Iran over the weekend, gold prices have seen fresh safe-haven demand. The futures market is firmly in the green today having gapped higher at the open, now trading up almost 2% from Frid...

Rising Safe-Haven DemandAmidst the market fallout from the US/Israel attack on Iran over the weekend, gold prices have seen fresh safe-haven demand. T

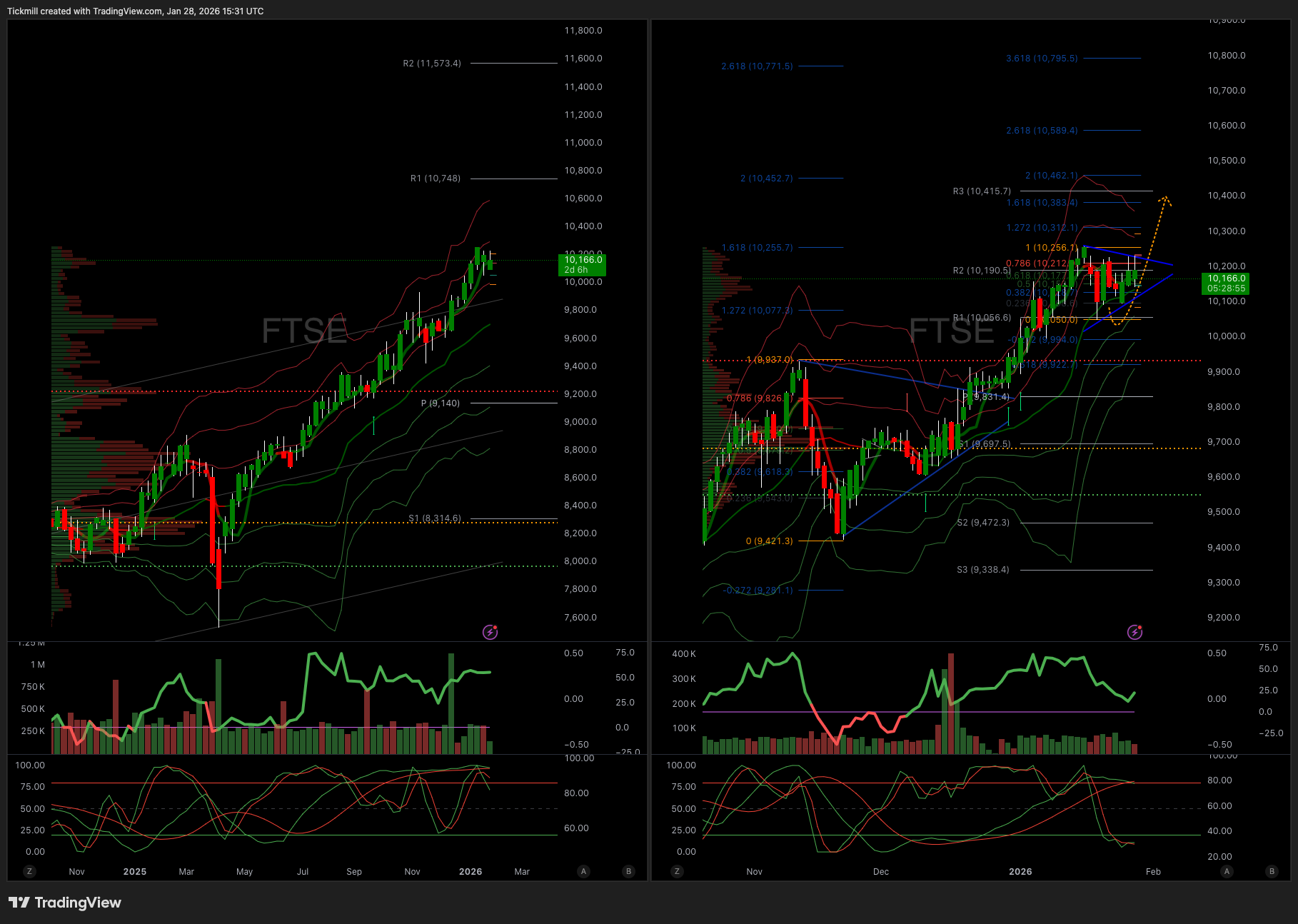

FTSE 100 FINISH LINE 2/3/26 UK stock markets faced a sharp decline on Monday of circa 1%, swept up in a global selloff driven by escalating tensions in the Middle East that rattled financial markets. The intensifying military conflict in the region spurred a signif...

FTSE 100 FINISH LINE 2/3/26 UK stock markets faced a sharp decline on Monday of circa 1%, swept up in a global selloff driven by escalating tensions i

.png)