Will Trump Cause Fireworks In Crude Today?

Crude Stabilises Following Sell-Off

Crude prices remain in the green today, though a little down from yesterday’s highs for now. Crude futures have stabilised following the sharp reversal lower from last week’s highs. Price found a floor around the 58.75 level with area remaining as support for now. The sell off last week came in response to news of fading US/Iran conflict risks as Trump note that the US would hold off form any strike on Iran after the government there offered assurances that violence against protestors would cease. Following that reaction, however, crude has started to grind higher again on rising geopolitical uncertainty around the US/Greenland issue. While any sort of US military action remains a very outside scenario, troops have been arriving into Greenland military bases from the US and some EU nations.

Trump to Speak Today

Looking ahead, focus today will be on Trump’s speech at Davos. With a high likelihood of aggressive rhetoric from Trump, oil prices could push higher on heightened geopolitical uncertainty particularly if EU leaders respond with a similarly aggressive tone tomorrow. However, upside in oil might be short-lived if tariffs come into play at the end of the month. Trump has threatened 10% tariffs against a slew of nations including France and the UK and the EU has threatened to respond with its own tariff package. If a trade war does erupt, that will weigh heavily on oil demand expectations.

Technical Views

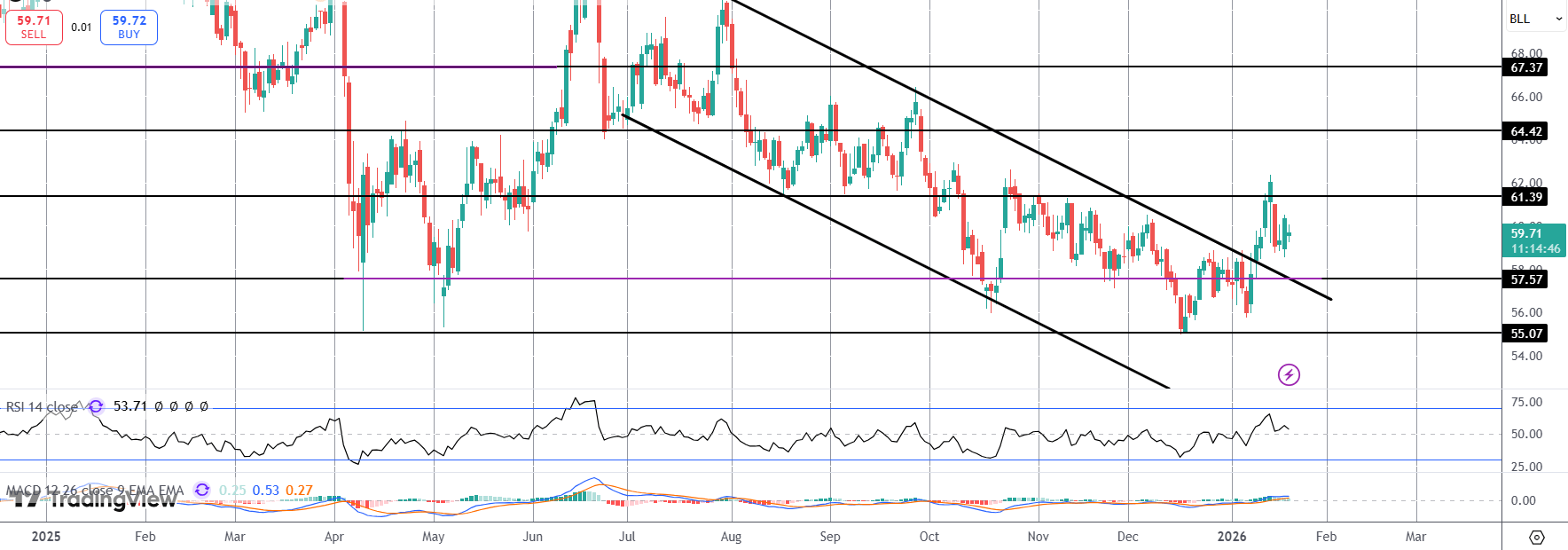

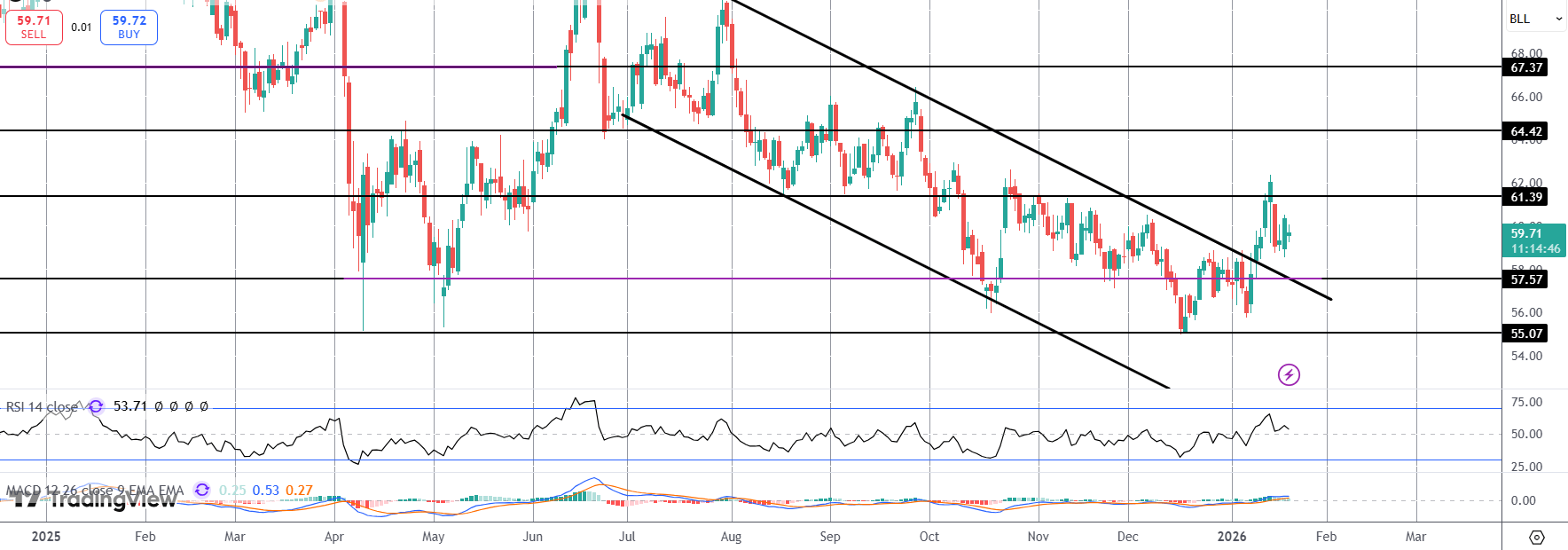

Crude

For now, crude is holding above the broken bear channel and the 57.57 level. While this area remains as support, focus is on a recovery higher and a fresh test above 61.39, targeting 64.41 next. With crude still looking like its carving out a base against the 2025 lows, the focus is on a push higher near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.